The “Why” of Alternatives – Alternative Investment Series Part 1

A few weeks ago, Lee Shertzer and I discussed alternative investments in this video. As advisors, especially during times of market volatility, it is not unusual to get asked the question, “Is there something else besides stocks and bonds we can invest in?” I encourage you to take a few minutes to watch the video to get a broad overview of what alternative assets are and a basic understanding of their pros and cons. As the first in a series of follow-up articles to that video, this post will expand upon the “why” of alternative investments mentioned in the video. Future posts will take deeper dives into specific types of alternative investments.

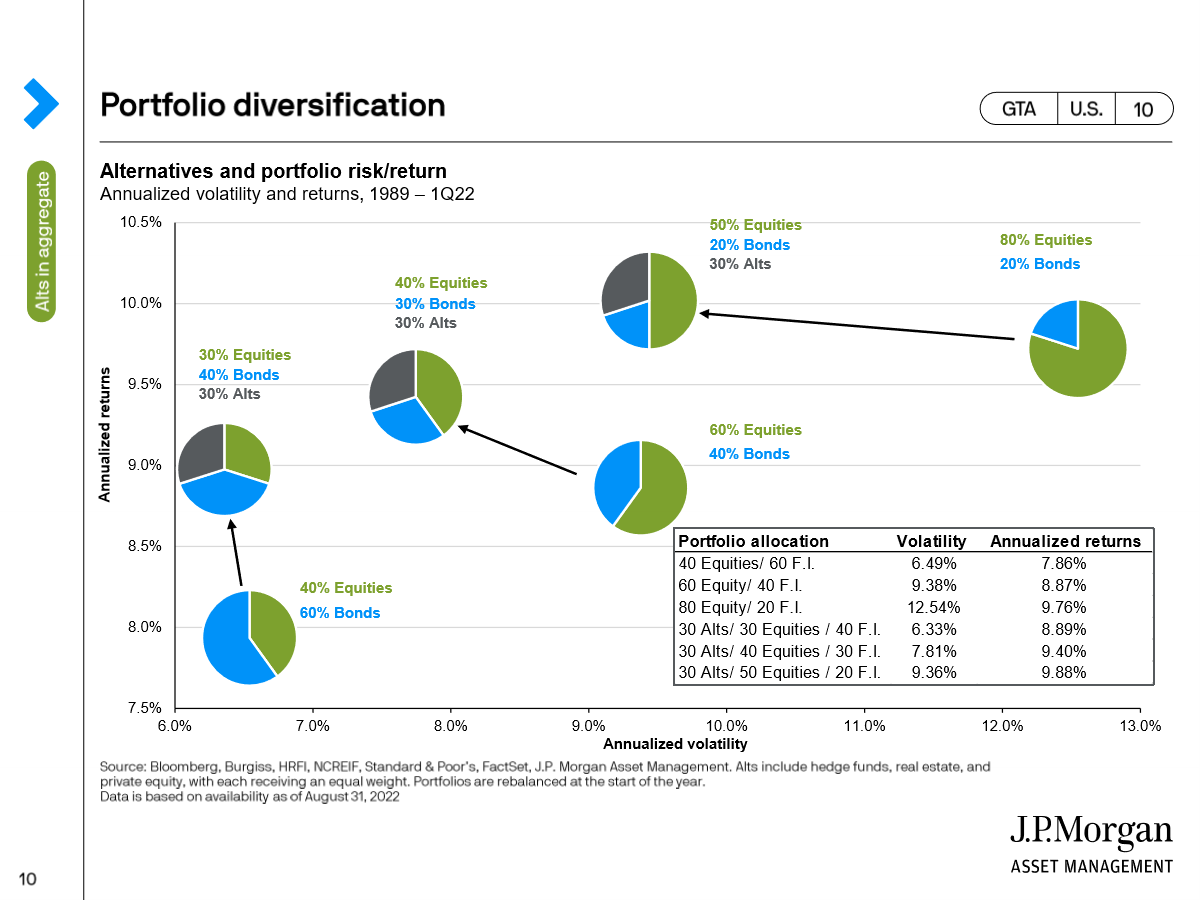

When we help clients draft financial plans for their lives, we stress the importance of understanding the “why” behind their goals, so investment choices should also address the why. In the case of alternative investments, we have modern portfolio theory to thank for the first “why.” Alternative investments have an interesting history which we will discuss in a moment, but when modern portfolio theory was first introduced in the 1950s and ’60s, it began to demonstrate how different types of investments work together to lower overall portfolio risk…even if they pose a higher risk on their own. So as alternative investments gained in popularity during the 80s, 90s, and beyond, modern portfolio theory demonstrated the value they can bring to a portfolio. Below is a chart provided by JPMorgan’s Guide to Alternative Investments which demonstrates the effect alternative investments can have on a portfolio.

In each portfolio from 1989-2021, allocating 30% to alternative investments slightly increased the returns, but more importantly decreased the volatility of the portfolios. In the case of a more aggressive investor, the return only increased slightly, but the volatility dropped by 25%! (This is my first disclaimer; I am not advocating for 30% of your portfolio moving to alternative investments, each situation is unique.)

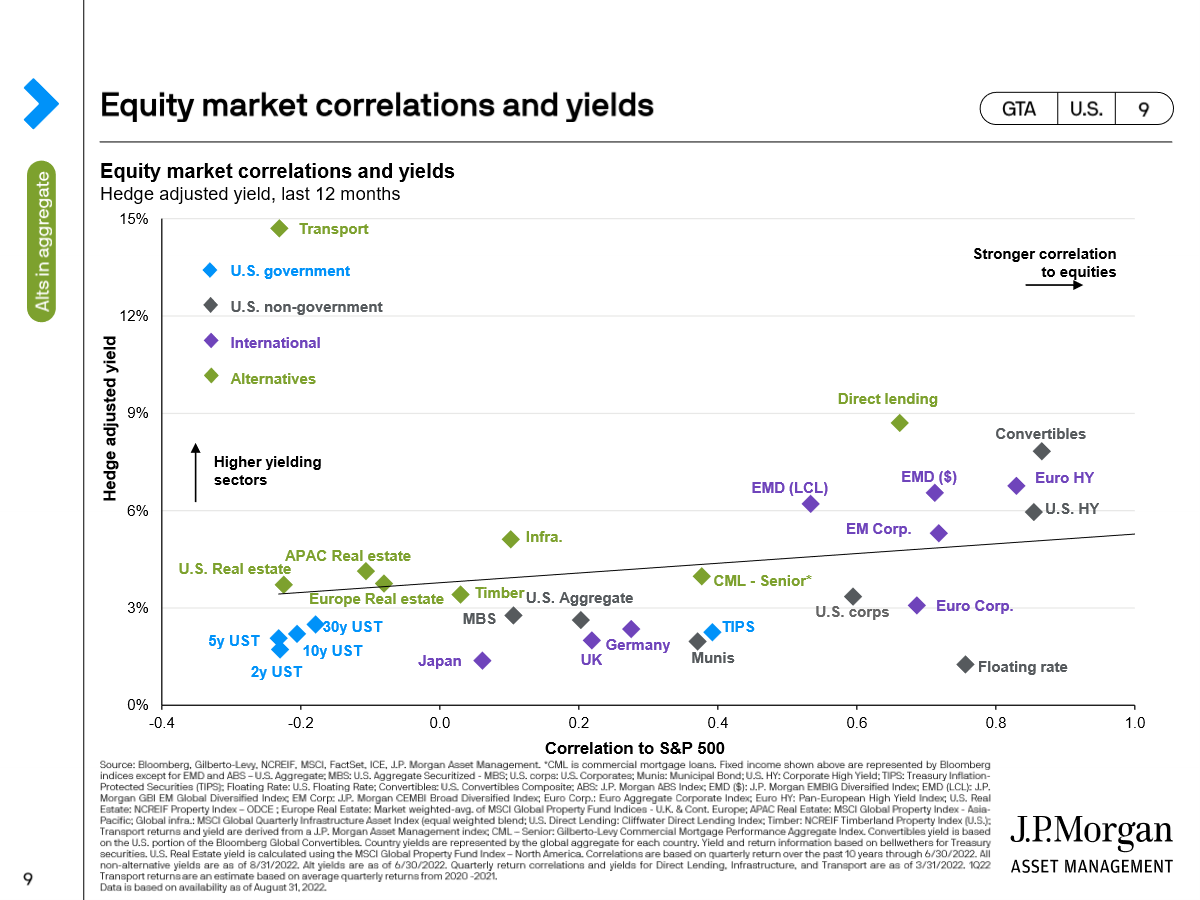

Another potential “why” for including alternative assets in your portfolio is due to the diversification of income. One thing that has caught some investors by surprise is the volatility in the bond markets. As of this writing, the aggregate bond index (AGG) is down over 14% for the year! This has forced some people to move further into traditional equities than they would normally feel comfortable doing to get income from their portfolios. As another chart from JPMorgan shows below, alternatives, especially those in the “real asset” space, could provide that missing income without the increased correlation to stocks. The further to the left of the chart an investment is, the less it moves in tandem with the stock market (correlation), while the higher on the chart indicates a higher yield (income.) For example, over the last ten years, which should come as no surprise, US Real Estate has been as correlated to the stock market as US Treasuries, but the income provided is substantially higher. Obviously, all of this could change as real estate has had an incredible run, but just like we recommend diversifying among stocks and bonds, we would similarly recommend diversifying among alternative investment types. Even timber (See J.P. Morgan’s chart below), while slightly more correlated to the stock market compared to US government bonds, has provided better income than US government bonds.

If this is the first time you are hearing about alternative investments, it can be tempting to dump this in the bucket of “the latest craze.” However, alternative investments have been around even longer than traditional stocks and bonds, but like certain clothing styles, they are coming back into favor. According to a report issued by the CAIA Association in 2018, most institutional quality investments in the late 1800s and early 1900s were those secured by tangible assets. From 1890-1920, the most popular institutional quality investments were government bonds, real estate, mortgages, and preferred stock. It was not until the 1920’s that we saw domestic equities become popular…and then we all know what happened in 1929. According to the same report, in 1901 the Dow Jones Industrial Average included 12 stocks; 10 common stocks and 2 preferred stocks and almost every one was a commodity producer. Today, top firms are dominated by services and technology. As of this writing, the top five US firms by market capitalization are Apple, Microsoft, Alphabet (Google), Amazon, and Tesla. Due to this trend, investments tied to commodities are viewed as alternative investments, yet they constituted most of the industrial investment opportunities in 1901. Clearly, a dynamic approach to portfolio management, one that adjusts for new industries and other economic changes, is needed to maintain good principles of portfolio diversification.

So why are we only really hearing about them now? The short answer is that until recently, most of these alternative investments were only accessible to institutional investors or those with large investment balances. However, as new investment structures have become available and legislation has changed, more people than ever have access to these types of investments. In future posts, we will take a deep dive into some of the specific alternative investment types such as private equity and real estate, and outline different ways to invest in these asset classes.

Finally, I need to end with a very important disclaimer. This post is not meant to say you should include alternatives in your portfolio. However, one of our core values of “Walking with you on Your Journey” is education, and we want to make clients aware of possible investment solutions. As usual, you should discuss with your advisor whether alternatives make sense for your portfolio and situation. With that out of the way, stay tuned for more posts in this series.

Like this article? Check out Investing Archives where we provide insights to help you weather changes in the market.