Lessons from Yosemite … The Final Three

Looking east through Yosemite Valley at Half Dome from the trail to Upper Yosemite Falls

The first two blogs I wrote about my time in Yosemite National Park centered on proper planning and dealing with interruptions. In this final article, I’d like to briefly address 3 important applications to finances.

Luck is not a strategy

While not substantiated, Thomas Jefferson is quoted as saying, “I am a great believer in luck, and I find the harder I work, the more I have of it.”[i] The successful excursion I had with my son-in-law was not left up to “luck,” and neither should your financial planning. We did our homework, physically conditioned, bought appropriate equipment, booked our stays, determined the points of interest we wanted to visit, and then executed our plan.

You too need to take appropriate action steps to be successful with your finances. That includes implementing wise investment principles that include establishing an investment plan, understanding your time horizon, taking a long-term approach, not timing of the market, diversifying your investments, investing with facts (not by emotions), expecting volatility (and using it to your advantage), rebalancing your portfolio regularly, and understanding the correlation of risk and return. Relying on “luck” should never be part of the equation!

Assessing opportunities

My son-in-law and I had an unplanned opportunity to summit Half Dome. Subdome was a very snowy hill which needed to be conquered before tackling the last 400 feet to the top of Half Dome. “Should we climb it or not?” we asked ourselves. While I approach new activities and unfamiliar situations with curiosity and interest, and have an eagerness to try new things, we decided that with all the snow, since the climbing cables to the top were down, and some additional equipment and upskilling was needed, it was best not to tackle the challenge at that time. It is on my “bucket list” for later.

Whether it’s a coworker giving you a “hot stock tip” or a friend or relative encouraging you to put money in a “can’t lose investment,” how do you assess the opportunity? When various opportunities present themselves, you need to judge the inherent risk(s) and potential reward(s). Good questions to ask are, “What is the upside gain verses the downside risk?” “Which is greater?” “Does this fit into my overall strategy and plan?” “If so, how; if not, why not?” Thoughtful answers to those questions will give needed insight. Ask wise council, if they’re available, as they can give pertinent information. Remember, it is better to pass up on a good deal than to be stuck with a bad one or have painful regrets later.

Have a contingency plan

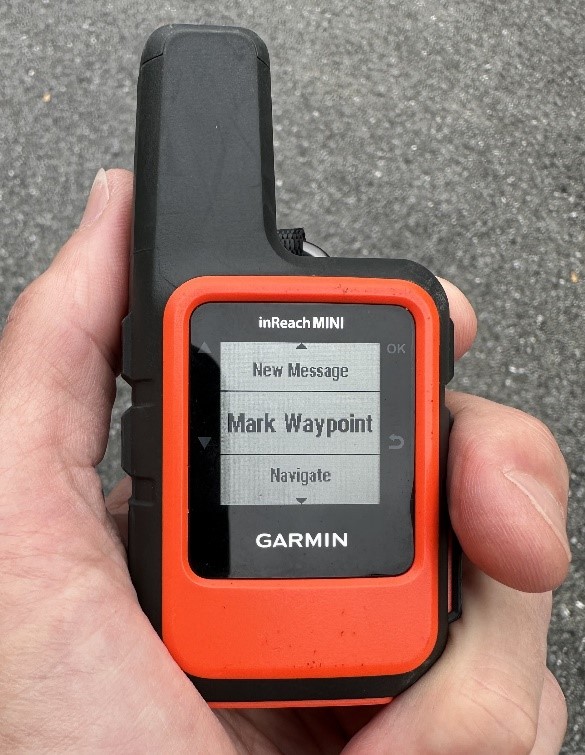

We took with us my Garmin inReach® satellite communicator, “just in case.” The inReach allows us to not only have global two-way messaging and texting through a Bluetooth connection with my cell phone, but more importantly, it’s equipped with an interactive SOS button that messages an emergency response center while sending out our GPS coordinates. Fortunately, we didn’t need to use it at all, but it was there “just in case,” if an emergency did happen.

We all need a financial “contingency plan.” It is called an emergency fund. Dave Ramsey states, “It is going to rain. You need a rainy-day fund. … Money magazine says that 78 percent of us will have a major negative event in a given ten-year period of time. The job is downsized, right-sized, reorganized, or you just plain get fired. … Car blows up. Transmission goes out. You bury a loved one. … Life happens, so be ready.”[ii] You ought to have enough cash in your emergency fund to cover 3 to 6 months of living expenses. You don’t want to have to borrow money when times are bad. Keeping the emergency-fund money liquid (i.e., easily accessible, non-fluctuating principal, no penalty to get it) in a high yield savings account or good money market account is prudent. It is there for you “just in case,” or should I echo Dave, “when life happens.”

Why Adventure?

Let me finish this series by ending on more of a philosophical note. Why adventure: what do we hope to achieve though it? For me, it brings a sense of calm, a quieting of the mind, restoration, refreshment, and gaining a renewed sense of calling. My daily preoccupations (e.g., home and work responsibilities) are drowned out by physicality, exertion, and beauty. It is a privilege to have an adventure – sharing the experience with those you love, being able to take off, living in a country that has wonderful places to visit, having physical senses to take in the surroundings, and owning quality equipment that performs well. For me, adventures are part of my life goals. Are they for you? What future adventures do you have planned? I’d love to hear about them.

Schedule an introductory phone call with Thomas at this link: Thomas Talbott – Introductory Phone Call

Like this article? Want to learn more about planning for life’s transitions?

Check out our Personal Finance Archives where we’ve compiled helpful articles to help you plan for your future.

[i] “Neither this statement nor any variations thereof have ever been found in Thomas Jefferson’s writings.” https://www.monticello.org/research-education/thomas-jefferson-encyclopedia/i-am-great-believer-luckspurious-quotation/

[ii] Ramsey, Dave. The Total Money Makeover: A Proven Plan for Financial Fitness. (Nashville, Tennessee: Nelson Books) p.97.