Investing Principles from a Mountain Bike Lesson

I recently had a chance to do some mountain biking in a beautiful part of the country. It had nice beginner-friendly trails under ponderosa pine trees that allowed me to get lost in the beauty of the forest…until I ended up on a trail that maybe I was not ready for just yet. Suddenly, rocks, trees, and roots interrupted my pleasant experience. As my bike started to bounce around, instincts kicked in and I grabbed the rear brake, started skidding around turns, and generally got tense…so much for that calming experience! It wasn’t until I spent some time with a mountain bike instructor that I learned some valuable lessons which can be applied to investing in “rocky” times. While the market has given us a bit of a reprieve (at least for now) from the negative news and selling, what can a mountain bike lesson teach us about investing?

1. Don’t squeeze the rear brake too hard

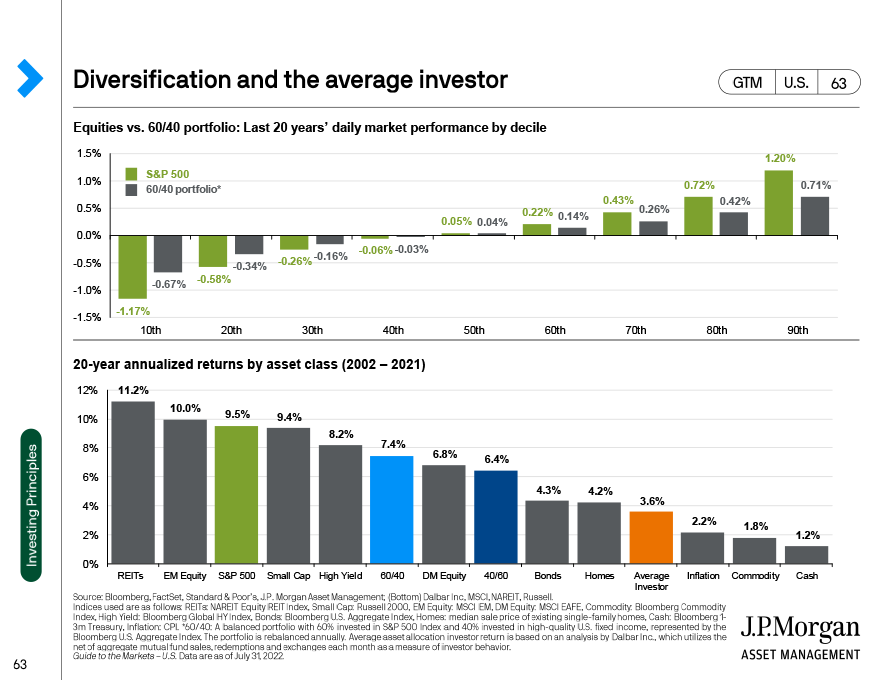

When I started feeling like things were getting out of control on my bike, my first instinct was to grab the rear brake to slow down or avoid an obstacle. As someone who’s experienced going over the front of their bike handlebars at 25 mph (it’s not a pleasant experience in case you’re wondering,) I was hesitant to use my front brake on the mountain bike. However, as is often the case with humans, our first instinct is not always our best instinct. While using my back brake seemed like I was doing something in the immediate term to help my situation, it made it worse as using the rear brake leads to skidding and sliding. It was not until my instructor reminded me to stay calm and taught me how to use the front brake, in tandem with the rear brake, that I learned the best way to stay under control. As humans, we tend to feel the need to “do something” as we fear inaction is the same as doing nothing. However, behavioral research indicates that “staying put” may be the best option. According to the chart below, provided by JPMorgan, from 2002-2021, the S&P 500 has returned 9.5% on average, while the “average investor” has just returned 3.6%. So, why has the average investor done so poorly compared to just buying and holding the S&P 500? Often, it is the feeling of needing to do something that leads to quick decisions that do not align with our long-term financial plan.

2. Look down the trail

One of the first things our instructor talked about was the importance of looking ahead or down the trail, not right in front of your wheel. As she said, “your bike goes where your eyes go,” so if you look at that tree instead of the path between the trees, you will have an intimate encounter with said tree. By focusing down the path, you will barely notice the rock your tire just rode over or the trees you just squeezed between. In our case, the path is your financial plan and that is where your focus should be, not the doom and gloom on tv or the internet. This is a great time to review your financial plan with your advisor to make sure nothing has changed in your job or family situation that warrants a change in the plan. By looking down the trail we can make course corrections before crashing into the tree or getting tripped up on the rock. Our life transitions survey is a great place to start a discussion with your advisor about upcoming transitions that should be accounted for in your financial plan. Knowing you have money already set aside for your transitions will allow you to roll right over the rock (market volatility) in front of you.

3. Position is critical

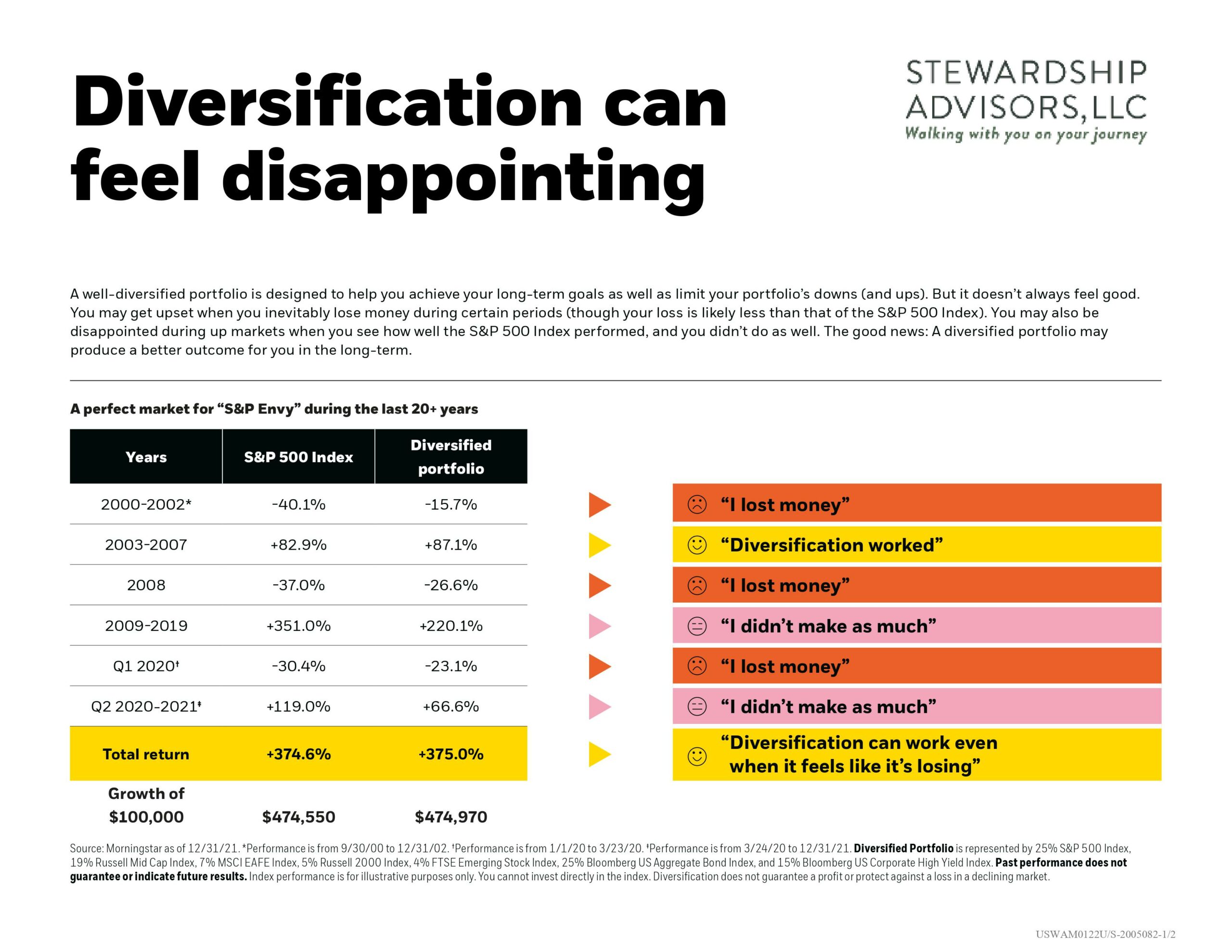

In another bike incident (sensing a theme here?) I found myself staring up at the sky in the “turtle” position. On a short climb, my weight got too far back on my bike and the bike came up over my head and I ended up on my back with my bike on top of me. This lesson taught me the critical importance of body position on the bike and was later reinforced by our instructor when she reminded us to stay in the “attack” position on the bike. Your portfolio’s “position” also plays a vital role in your financial plan. Over the last few years, diversified portfolios have not performed as well as the S&P 500. In future articles, we will look at ways to possibly improve this asset allocation experience, but for now, look at the chart below from Blackrock. It demonstrates the emotions investors with a diversified portfolio have probably experienced over the last twenty years. As part of your financial plan review mentioned above, part of that review should include risk analysis, in other words, how much risk are you willing to take in your portfolio? You can assess whether you are in a good position to take advantage of market opportunities that may have arisen during this downturn. If you have a long-term investment horizon, now may be a great time to invest if you have extra cash. Or a re-assessment of your risk means you may take some money out of bonds into more aggressive parts of the market. While it may seem counterintuitive to put money into investments while it’s declining, this will help you recover faster…it’s like buying things on sale!

I am far from a mountain bike expert, but just one lesson with an instructor significantly increased my confidence on the trails and made my riding more enjoyable. These investing principles are nothing new, but just like any good coach, we like to remind clients of these fundamentals during tough times in the market. In doing so, our goal is to ensure your ride to your ideal financial future is as smooth and enjoyable as possible.

Like this article? Check out The Market Archives where we provide insights to help you weather changes in the market.