Beyond Politics: Proactive Financial Planning Amidst Tax Law Sunsets

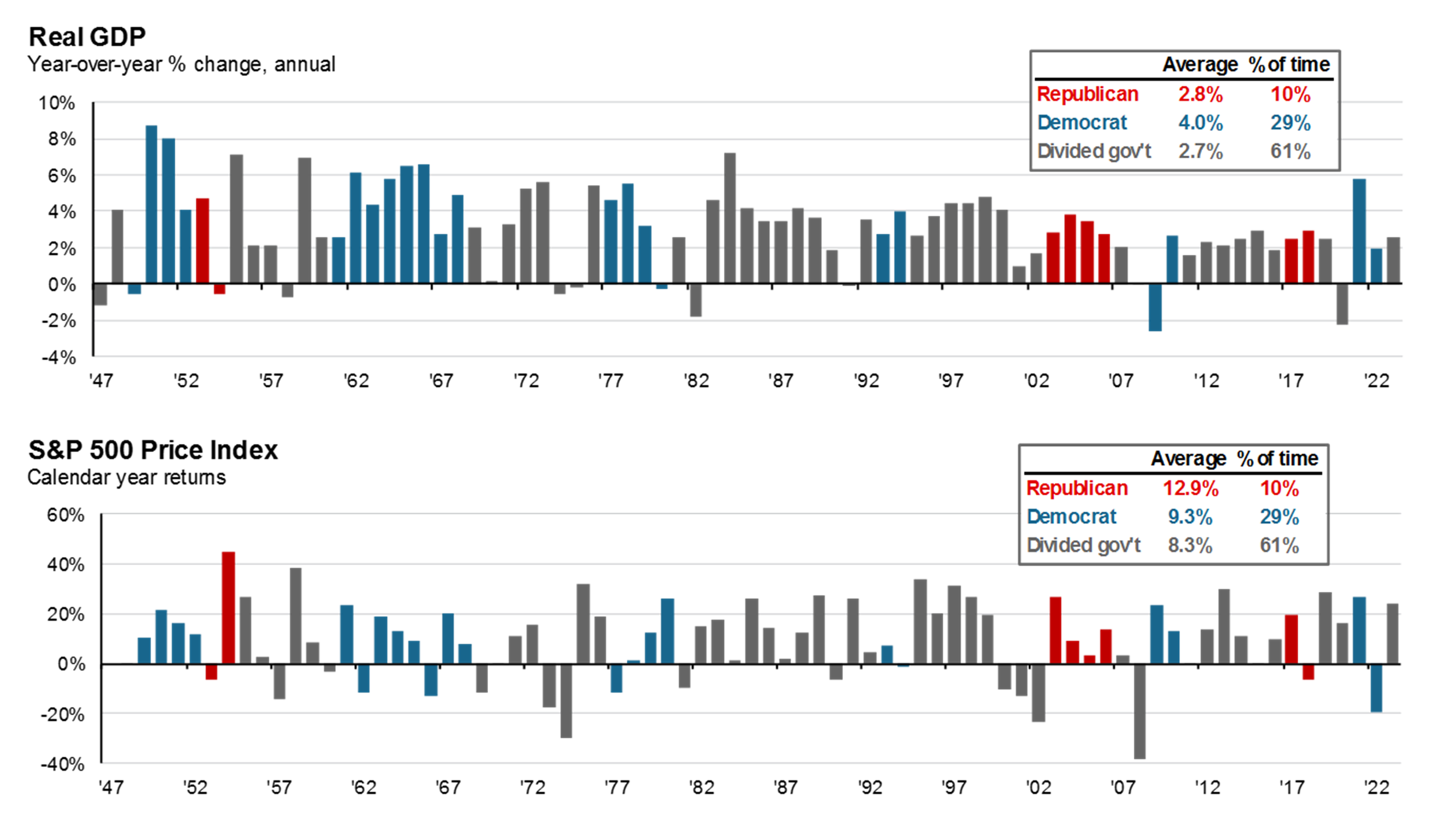

As financial planners, we often tell our clients that it’s better to prepare than repair. Recently, a question that has been posed in a few of my client meetings, (and will likely come up more frequently until November) is “What does the election mean for my portfolio?” While delving into that answer can be complex and beyond the scope of this article, rest assured we are not turning a blind eye to the elections. It is crucial, however, to keep the election’s impact on your portfolio in perspective. Despite the circulation of various “rules of thumb” regarding election years, historical data reveal that using political parties as a guide for investment strategy may not be the wisest approach. To this end, JPMorgan provides a chart illustrating economic growth and average stock market returns during the control of each political party. In essence, markets fluctuate, irrespective of the political party in power.

There is another noteworthy aspect to this election, however, that could influence financial planning strategies. If Congress does not act, several provisions in the Tax Cuts and Jobs Act of 2017 are set to expire at the end of 2025. When a law “sunsets,” it means the original bill was only effective for a specific period. In this case, the bill was effective for nine years, and will automatically revert to its previous state unless Congress acts to extend or make the changes permanent. Given the current political landscape, there is not much optimism about Congress swiftly addressing this pending “sunset.” So, if they do expire, there are a few things you can do to prepare yourself both financially and mentally for the changes.

Roth Conversions in the Next Two Years. With the Tax Cuts and Jobs Act (TCJA), individual tax brackets were reduced. Converting to Roth accounts now, before the potential expiration of the TCJA, can lead to tax savings in the long run. Below is a table of the expected tax rates, both now and in 2026:

|

Current Rate |

Tax Rate After Sunset |

|

10% |

10% |

|

12% |

15% |

|

22% |

25% |

|

24% |

28% |

| 32% |

33% |

| 35% |

35% |

| 37% |

39.6% |

One of the ways to evaluate Roth conversions is to “guesstimate” your future income tax bracket. While that may be hard to predict for ten or twenty years down the road, it is probably easier to see that in two years, even if your income does not change, your tax bracket will most likely increase. It will be especially important to evaluate Roth conversions if you expect your income to be above $190,000 as that is where the sunsetting not only affects the tax rate, but the tax bracket income ranges.

Resume Tracking of Charitable Giving and State and Local Income Taxes. The TCJA doubled the standard deduction and placed a cap on how much people could deduct for their state, local, and property taxes. For many people that resulted in claiming the standard deduction instead of itemizing their deductions. This also meant that they did not take a deduction for their charitable giving. One silver lining for some people was that it meant they did not have to track those receipts as closely. However, if we revert to previous standard deduction levels, tracking your charitable giving and other deductions becomes an important task

Estate Planning and Charitable Giving Adjustments. The TCJA significantly increased the estate tax exclusion, almost doubling it to $13.61 million (2024) for couples. If the TCJA sunsets, the exclusion may revert to an estimated amount of $7 million, potentially impacting estate planning strategies. Fortunately, the IRS has issued regulations that state they will not “claw back” excess gifts made during the increased lifetime exemption. For instance, if you made lifetime gifts of $9 million in 2025, then pass away in 2026, the IRS will allow your estate to take the full estate exemption of $9 million, not just the $7 million.

Changes in 529 Plan Distributions. One final area we are monitoring is the changes to 529 plan distributions. Many of our clients value education and want to help children or grandchildren with tuition related expenses. The TCJA expanded the use of 529 plans beyond post-secondary education, allowing distributions for K-12 education costs. In addition, many states, including Pennsylvania, offer a state income tax deduction for 529 plan contributions. One strategy that we have helped clients implement is to use 529 plans as a conduit to pay for K-12 education costs and claim the state tax deduction. If the law sunsets, we may have to look elsewhere to help lower your state income tax bill.

As the uncertainty surrounding the fate of the TCJA looms, it’s essential for investors to proactively assess and adapt their financial plans. Collaborating with a fee-only financial planner, such as Stewardship Advisors, can provide the guidance needed to stay informed, consider potential scenarios, and navigate uncertainties, positioning oneself for financial success in any tax, or political, environment.

Schedule an introductory phone call with Mark at this link: Mark Brinser – Introductory Phone Call

Like this article? Check out our Investing Archives where we provide insights to help you weather changes in the market.