Certified Investment Management Analyst®, CIMA® certification

Certified Investment Management Analyst®, CIMA® certification

I looked at the CIMA® certification program for a few years before I had the courage to take on the challenge of working through a new certification program. What was appealing to me about the CIMA® certification program was its deeper dive into the fundamentals of portfolio construction, security selection, and behavioral finance—understanding how to apply a balance of theory, practical knowledge, and providing insightful guidance. I thought it would be useful in refining my skills in portfolio construction, portfolio management, and risk management for individual and institutional clients. Behavioral finance was another area that I was excited to take a deeper dive into—understanding the why behind a person’s reasoning for decision-making has helped me develop a more insightful conversation to explain a new idea.

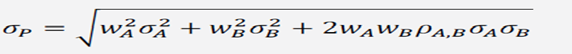

The CIMA® certification program has a lot of math that I would need to master which was a concern when starting the process. I have never taken a statistics class and the last time I needed algebra was in junior high. I would have to force my brain to look at a problem like this: and not have my eyes glaze over. This is the formula for the Standard deviation of two risky assets. Once you understand the equation it was not hard to work through, but it took a lot of time to get to that point. Statistics was a core part of the analytical tools one needed to master in order to understand and work through all the different formulas the certification program used in the analysis of portfolios.

and not have my eyes glaze over. This is the formula for the Standard deviation of two risky assets. Once you understand the equation it was not hard to work through, but it took a lot of time to get to that point. Statistics was a core part of the analytical tools one needed to master in order to understand and work through all the different formulas the certification program used in the analysis of portfolios.

The Certified Investment Management Analyst, CIMA® certification was developed in 1988 by the Investment & Wealth Institute. In April 2011, CIMA® certification gained accreditation from the American National Standards Institute (ANSI) now the National Accreditation Board (ANAB). I applied and was accepted into the Investment & Wealth Institute’s CIMA® certification program offered through the Yale School of Management.

What I learned along the way about myself, study habits at an older age, and having to rethink some of the biases I developed over the years to what I learned in the certification program. The program took me over a year and a half to complete. I had to work through periods of disbelief that I was not smart enough, too old to learn all this new material, and the math made my head spin. I did not pass the first time I took the test (The passing rate is 48% on the first CIMA® exam). I called my wife after each test. She would ask me if I passed; I told her I had the opportunity to take the exam again. The exam format changed in the middle of my studies, which caused me to go back to the beginning of the program and start rereading all the material again.

When I started in financial services I had to take the Series 7 test. I was given two months to study and take the test. If I passed, I would move on to the next part. If I failed, I was fired. I remember studying and taking practice exams 8 hours a day. I passed that test, the first time. The next certification program I went through was the ChFC® (Charted Financial Consultant®) followed by the CFP® (Certified Financial Planner®) certification which took two years to work through all the sections and material. The CIMA® certification process was just as demanding as the CFP® certification process. The CFP® certification is focused on broader financial planning expertise. While the CIMA® certification program focuses on advanced investment management strategies, portfolio construction, and risk management.

You might be more familiar with the CFP® designation; about 30% of financial advisors have a CFP® mark, compared to just 3% of advisors who have the CIMA® designation. With an increasingly more complex financial world, advisors will need to attain the CFP® certification to show depth of knowledge in financial planning. Just as an accountant needs to attain the CPA® designation to show depth of knowledge in accounting. The CIMA® designation provides advisors with the tools to go beyond investment fundamentals.

I am looking forward to applying this new knowledge base that I gained through the certification program. My wife asked me if I was done with adding designations after my name. I told her I have my eye on another designation I am looking at to add to my skill set in the near future.

~ John Simkins CIMA®, CFP®, ChFC®, ….

Schedule an introductory phone call with John at this link: John Simkins – Introductory Phone Call

Like this article? Check out our Investing Article Archives where we’ve compiled helpful investing-related articles to help you plan your financial future.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.